- The Castle Chronicle

- Posts

- Deciphering GMX v2: The Next Wave of Decentralized Perps

Deciphering GMX v2: The Next Wave of Decentralized Perps

Castle Capital Research Report

This in-depth analysis focuses on GMX, a prominent player in the decentralized perpetual trading ecosystem, and its transition to v2.

Our exploration is centered around the key enhancements this upgrade brings, what they signify, and the potential risks we might anticipate from this new roll-out. We delve into the revamped pricing model and operational mechanisms that underpin the protocol, both of which are undergoing significant transformations with the advent of v2.

A deeper dive into the trading functionalities on this platform, the reshaped fee structure, practical trade examples, and innovative trading strategies like delta neutral farming and pair trading, form an integral part of our study.

To provide a well-rounded understanding, we incorporate comparisons between GMX and its market counterparts throughout our investigation.

Not a subscriber yet? Sign Up Today to reveal the download link for the Full Report PDF!

1. GMX v2: A Catalyst for the DEX Derivatives Market?

1.1 GMX v1: A Success Story

GMX v1 has been arguably the most successful model within the decentralized derivative trading industry with a rather simple but convenient model for LPs and traders.

The total volume on the platform is almost $138B since launch, having collected and distributed more than $217M in fees among liquidity providers and stakers as well as onboarding almost 300k users into the platform.

These figures make GMX the 10th largest protocol in terms of revenue within the on-chain crypto ecosystem (over the last 365 days) with $144.3M in fees, battling with some of the largest chains and protocols in the space.

Source: TokenTerminal

But, how is it faring against actual competitors?

Considering competitors in the whole derivatives category (perpetuals, expirable futures, and options), GMX is the strongest player in the segment by a wide margin, as can be appreciated in the chart below (representing last year’s revenue for derivative projects).

Source: TokenTerminal

From this data, we can extract a few conclusions:

GMX generates one-third of the total revenue of all derivatives

dYdX and SNX/Kwenta are the strongest contenders for the crown

Decentralized perps represent more than 90% of the derivatives revenue

1.2 Limitations of the GLP Model

GLP is a unique multi-asset pool design. As a basket of assets, you can look at it as an index of sorts, where the overall price is the sum of the weighted price of each asset. Therefore, as BTC, ETH, and other volatile assets make up the index, the GLP token itself has a directional bias on the market. It will increase in price with BTC and ETH, and it will decrease in price with BTC and ETH.

Secondly, GLP acts as the ‘house’ in the GMX casino, whenever a trader wins or loses, GLP holders are on the other side of the trade — they are the counterparty to the traders. Therefore, as a GLP holder, you are betting on traders to lose money over time. If you want to invest in GLP and earn fees, you need to be sure that your income outweighs any losses.

Every model has some limitations, and GLP is no exception. Some of them have been already addressed by competitors while others remain open for solutions.

Let’s take a look at each of them in detail:

Unbalanced Open Interest (OI) with higher risk to LPs

Open Interest is the total amount of exposure to the market traders on the platform have. It consists of both long and short exposure and a balanced pool would have 50% long exposure and 50% short exposure to a given asset.

The GLP model did not introduce funding fees, but a variation called borrow fees, that charge both sides (long & short) for opening trades in the platform.

While the dominant side pays more, both sides are charged, so there is no incentive for arbitrageurs to step in and arb that potential difference with other platforms, bringing the OI back to parity.

While borrow fees work great to ensure trades are not open indefinitely without paying fees, it does not manage to balance both sides of the pool. As a result, LPs have a larger than desirable exposure to trader performance.

Even though GLP has earned $22M on top of fees due to players losing against the house, a balanced OI results in lower exposure to trader PnL and therefore a more predictable payout and delta position for LPs.

The Trader Net P&L chart on Arbitrum is very illustrative of why some more predictability would be very desirable by LPs (big swings both up and down on liquidation events)

Source: stats.gmx.io

Higher fees for small/medium size trades vs other venues

The current fee structure is very attractive for big-size players due to the zero-slippage function, but not so much for small/medium traders who will find better quotes at other venues due to the 0.1% open/close fees on GMX v1.

To attract retail and be appealing to a mass audience going forward, in a context where more and more competitors emerge, fees for smaller trades need to be reduced.

General exposure to a basket of assets for LPs

While GLP has proved to be a great tool to bootstrap liquidity due to its simplicity, it also has some disadvantages.

One of the main ones, is liquidity providers are exposed to a basket of crypto assets that makes hedging hard and might contain assets that some LPs don’t necessarily want to have exposure to.

Few tradable assets

One of the most legitimate criticisms against GMX is the low amount of trading pairs on the platform.

Currently, GLP offers 5 different assets to trade (BTC, ETH, UNI, LINK & AVAX) while other competitors offer up to 50 assets.

While most of the trading activity overall takes place in BTC & ETH (around 75% of total volume) traders usually want to bet on some other assets that might be beta plays at certain times (p.e. important announcements, token unlocks, etc).

Poor capital efficiency/utilization blockers

As a direct consequence of zero slippage and the current low liquidity in the markets, a large part of the liquidity cannot be used (to prevent exploits due to oracle manipulation between CEXs/GMX).

Another limiting factor is the unbalanced state of the pool. Currently, only 40-50% of the pool can be utilized due to protocol caps, put in place to avoid overexposure to one side of the market. Therefore, the capital efficiency could be doubled if the liquidity pools become more balanced long/short-wise.

1.3 GMX v2 Enhancements and GMX's Market Dominance

V2 aims to provide a solution that fixes most of the existing issues within the derivative sector and further cement GMX dominance within this vertical in an attempt to follow the Uniswap path of constant version innovation but in the decentralized perp industry.

Think of the GLP model as the Uniswap V2 for perps; a simple and easy model to understand for both traders and LPs that achieved mass adoption.

As a result of mass adoption, both products faced the emergence of several competitors, many of them forks on other chains or even on the same chains (e.g. Sushi). With the release of Uniswap v3 with a business license, forks were not allowed for two years, leading to their growing dominance as competitors did not manage to deliver the same kind of specialized product.

There is a good chance GMX v2 deployment has the same effect on the perp space that Uniswap v3 had on spot DEXs. The similarities and the main competitive advantage remain the same – liquidity.

The primary location of liquidity in a sector will determine where activity, volume, and fees flow.

2. Decoding the New GMX Model: What's in Store?

2.1 Enhanced Fee Scheme for Traders

There are some important modifications in the new fee scheme concerning the previous version:

Halving of the open/close fees from 0.1% to 0.05%.

Introduction of funding fees that pay the less dominant side.

Retain borrow fees to ensure the pool OI is not hoarded at no cost.

Implementation of price impact (not favorable, especially for mid-big trades)

Big changes, right?

To understand how they affect the market positioning of GMX, let’s take a look at the rest of its competitors.

There are big differences in the fee levels and mechanisms established by every player, so it does not make sense to make an apples-to-oranges comparison, but here are the main guidelines to serve as a reference:

dYdX: 0.02% maker / 0.05% taker base - substantial discounts on volume

GMX v2: 0.05% open/close + funding fees + borrow fees + price impact

Kwenta: 0.02% maker / 0.06 - 0.1 taker base + $2 for the execution fee

GNS: 0.08% open/close + 0.04% spreads + price impact

GMX v1: 0.1% open/close + borrow fees

LVL: 0.1% open/close + borrow fees

The v2 update moves GMX from the high range of the market to the low range. Time will tell how this modification affects the demand for perps on the platform.

Based on last year's performance, it seems like fees are not the only deciding factor for traders, but liquidity might be even more important as if traders expect to net a good profit, they don’t mind paying high fees.

2.2 An Innovative Liquidity Provision Mechanism

In the new model, volatile markets will be collateralized in ETH for longs and USDC for shorts to allow for more flexibility and scalability of liquidity.

Additionally, liquidity for each pair will be isolated, allowing liquidity providers to select the pairs they wish to commit liquidity to based on their risk appetite/returns.

On paper, returns on large-cap pairs will be smaller but safer. The riskier shitcoins will probably have higher APRs due to high volumes but there is a higher risk of losing capital to trader P&L if the pools are not balanced (due to a higher volatility vs ETH).

The introduction of funding fees will make new pools more balanced concerning GLP, which is another positive development for LPs, as they will have less exposure (or even 0 in the fully balanced case) to trader P&L.

The trade-off is that bootstrapping liquidity will be a harder process due to fragmentation, where some pools might have difficulty attracting enough liquidity.

2.3 Expansion of Tradable Markets

Under the GLP model, every tradable asset needed to be included in the GLP pool, but that is not necessary under the new model. Tradable pairs can be added without the need for liquidity providers to have exposure to the asset, as some markets will be collateralized with ETH and stables instead of the hard asset, while others will remain collateralized by the hard asset (ARB/USDC will be backed by ARB but LTC/USDC will be backed by ETH)

This method of collateralizing markets has one disadvantage though. Very profitable long trades might end up not collateralized if there is a large difference between the value appreciation of the ETH and the selected asset.

To solve this issue, a new feature will be introduced, called Auto-Deleveraging (ADL), that will automatically close some trades at a certain amount of profits to avoid collateralization problems. This will only affect a tiny amount of trades and is only supposed to kick in for edge cases.

Moreover, the inclusion of a price impact calculation solves the problem of oracle manipulation in low-volume coins. This attack vector is an important one in GLP that is solved by design, not supervision, with the new model.

2.4 Elevating User Experience (UX)

Additionally, there will be a couple of features that improve the user experience substantially. Both of them are quite innovative and translate directly into order execution, which currently is the main pain point of oracle-priced perp DEXs.

Low-latency oracles: Faster oracles will make frontrunning harder and will smooth the experience regarding entry/exit price and time required for orders to be executed. These oracles are a brand new Chainlink product and GMX will be the first protocol to implement them.

Lookback orders: Limit/stop orders will be always executed as long as the oracle reaches the selected price, even if the price changes happen very fast (in the previous version some orders did not always execute on high volatility times)

3. Understanding the v2 Rollout and its Implications

3.1 Securing IP Rights

To protect some of their IP against forks, GMX DAO decided to deploy v2 under a licensed agreement that won’t allow protocols to fork the code without permission from the GMX DAO.

The GLP model was released fully open-sourced, but considering the vast amount of forking witnessed in the last two years, contributors decided to restrict the code through a license. In this situation, the code would still be public and code issues are easier to detect.

3.2 Insight into Dev & Auditing Process

Innovation comes at a cost, and the fact that most of the v2 code is brand new implies a bigger security risk. This is the main reason why the development process has taken so long (around 9 months, 3 times more than v1 took).

Contributors have taken special care in the design and auditing processes to be as safe as possible. Some of the firms that have been in charge of GMX audits are Guardians, Sherlock, and Certora.

Sherlock has already published their findings, with GitHub Issues and a full audit report.

Currently, the project has been deployed in a testnet phase both on Avalanche Fuji and Arbitrum Goerli to fix all the potential issues that could remain UX-wise, which we have been lucky enough to get our teeth into.

3.3 Exploring the Implications for Project Stakeholders

There are three main stakeholders of the project (liquidity providers, traders, and stakers).

GMX stakers will still get a share of the fees. Whilst exact percentages remain undecided, clearly the more fees the new product accrues, the better for $GMX stakers.

As fees for traders will be cheaper, the product will need to make up for it with higher capital efficiency and volumes.

Small and mid-size traders will enjoy way cheaper fees (around 50% of current ones) and a better user experience.

Depending on how the new price impact mechanism affects big trades, some of the largest traders might prefer using the GLP model which could end up being way cheaper for them due to the current zero price impact in v1.

Last but not least, liquidity providers will be able to manage their risk much better and deploy delta-neutral strategies through built-in mechanisms of the protocol (more on this later).

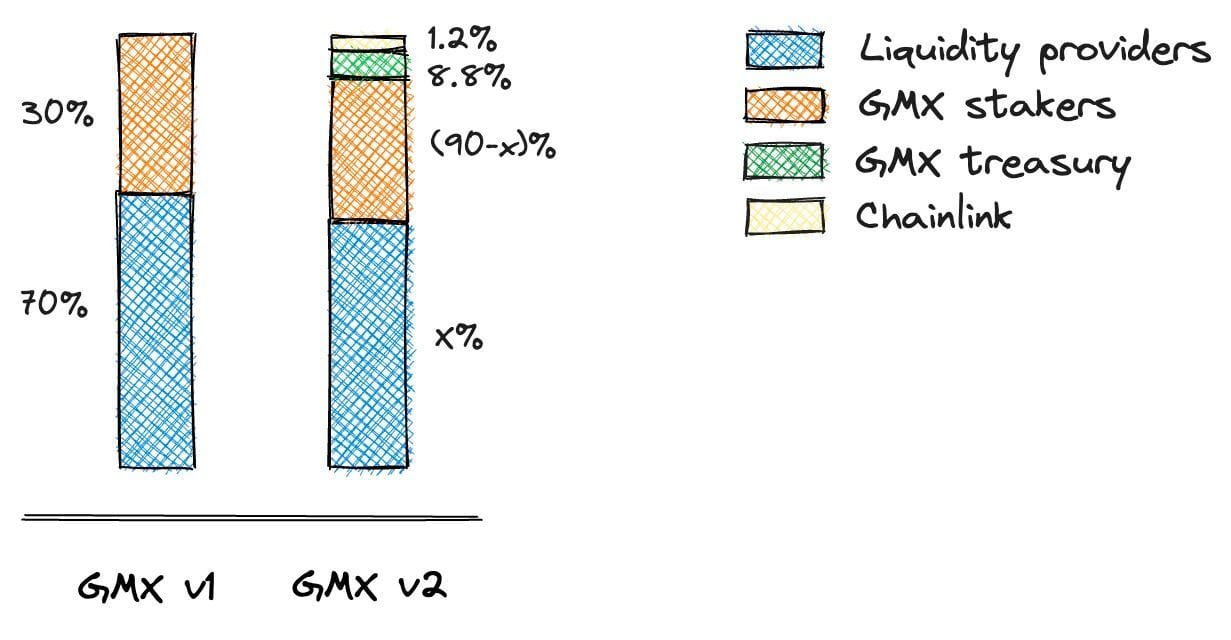

3.4 Treasury & Chainlink Profit Sharing

Currently, 100% of fees are distributed between liquidity providers and $GMX stakers, but this presents a challenge to the long-term health of the protocol.

Up until this moment, the operations were funded through the previous esGMX sale, around 18 months ago. Around $1.5M was raised from distributing 2% of the token supply. The protocol also earns fees from the protocol-owned liquidity (POL) in other decentralized exchanges.

This has worked well up to this point but is not sustainable on a long-term basis. To ensure the protocols’ stability in every market condition, the DAO voted to redirect 8.8% of the GMX v2 fees to the treasury of the project.

Moreover, 1.2% of GMX v2 fees will be paid to Chainlink to guarantee first-class service and priority in the next integrations.

GMX Fee Distributions

3.5 Starting Line-Up: Pairs Available at Launch

While this is not confirmed, our best guess of the available pairs at launch are:

BTC

ETH

ARB

AVAX

SOL

DOGE

UNI

LINK

These will vary on Arbitrum and Avalanche, and some of these pairs (among others can already be found on the testnets. We have predicted an initial total of 8 pairs, which is nearly double the pairs the GLP model offered. Some of these assets will be paired with both USDC and DAI to offer more options for liquidity providers.

Expect more assets to be added shortly after, even though GMX will probably not list every shitcoin on the market but rather focus on the big opportunities with enough demand to avoid fragmenting liquidity.

4. Opportunities and External Influences in GMX v2

4.1 New Avenues for Third-party Collaboration

New mechanisms will open interesting opportunities for all those protocols willing to build products on top of GMX.

The main use cases will be:

Liquidity provider managers

New liquidity-providing mechanisms will encourage more active management of the positions to migrate from the low-volume pairs to the ones that are more active at certain times.

In this context, some liquidity managers might arise, like the ones that did with Uniswap v3 (e.g. Arrakis) to fill that niche in the market. First movers with solid products will probably be rewarded.

Yield protocols focused on farming funding fees

Farming funding fees can be a profitable business model, but it has previously presented some challenges:

Relying on CEX might not be within the acceptable risk parameters

Not enough liquidity to do it fully on-chain (as the only venue paying funding rates with big sustained OI levels was dYdX)

Spreads within the different venues need to be big enough

In short, conditions were not great to create strategies around farming fees, so mainly MM or prop firms did it. With the launch of Kwenta a few months ago and GMX v2 this might change, and a new niche will open for decentralized players that extract yield solely based on funding differences across the three main venues (dYdX, GMX, and Kwenta).

Options AMMs & structured products

Considering GMX v2 is probably going to be one of the cheapest and most liquid venues for perps on Arbitrum, most of the Options AMMs and Structured Products will use it (some are already using the GLP model) to hedge their pools or even build more complex products (like the non-liquidatable perps of Dopex). Expect Lyra, Rysk Finance, and Dopex to all take advantage of this new design.

These products create constant flows through the protocol and help maintain good activity levels even in low-volatility environments. As we all know, liquidity is king and needs to be kept around.

Front-end trading suites

An important innovation that GMX is introducing is a profit-sharing scheme with external protocols that route volume through GMX pools. This creates an incentive for other projects to step in and focus heavily on providing the best UX and improving on traders’ needs. It is not presently clear what this fee structure would look like, but we envision it being low (<5%).

This creates a clear market niche for those projects that manage to create more appealing front-ends than GMX, as with enough volume, it could become a very profitable business model.

4.2 How External Factors Influence GMX v2

The general context of the crypto markets will have a lot of effect on how this new deployment fares in the short to mid-term. The most important levers to take into account, in order of importance are:

The general state of the crypto market

Overall trading volumes are highly dependent on the state of the market. Volatility and the willingness of traders to bet are positively correlated to higher trading volumes and thus higher fees for the exchanges that facilitate those trades.

The analysis of derivatives trading volumes over the last 3 years clearly shows this effect. While the trading industry has experienced notable growth in volumes during this period, the peak was reached during the height of the bull market in 2021 (900% growth from March 2020). Whereas, looking at current levels, there have been about 400% growth vs March 2020.

Source: Coinglass

Currently, we find ourselves in a bear market with a lot of apathy that resembles the 2019 market, so volumes are quite depressed and that will negatively affect GMX v2 volumes.

Exodus from CEX to DEX

There is, however, an ongoing exodus from centralized venues to decentralized ones due to regulatory pressure and the lack of trust in centralized players after the FTX/Celsius/etc. disasters.

This transition has been happening at a rapid pace, especially with more mature financial segments within crypto like swaps/spot trading. According to the block DEX swap market share moved from 0.52% in March 2020 to a new ATH of 22% in May of this year.

Source: TheBlock

Recent events, such as the FTX and Celsius fallout, but also the enforcement of KYC on a lot of popular CEXs, have boosted this transition. It would not be strange that perp dexes could reach 10% of the market by the end of the year/mid-2024 (currently standing at 3% DEX/CEX volume).

$ARB emissions into main Arbitrum protocols

42.78% of the $ARB supply belongs to the treasury of the Arbitrum DAO, and a big chunk of those tokens are likely being used to incentivize the activity on the chain, probably following a similar model to Optimism and granting tokens to promising products in Arbitrum.

GMX is currently one of the flagship protocols on Arbitrum. Tokens received from the initial airdrop will be used to properly participate in governing the chain so we could see GMX receiving additional funds to incentivize and popularize the second iteration of the platform without compromising on the share of governance power.

It is still yet to be seen how the GMX team decides to use the $ARB tokens they will potentially receive. Still, incentivizing liquidity providers and possibly traders in the form of some competition is a likely scenario.

Competition in the decentralized derivatives segment

There is fierce competition in the segment, as derivatives exchanges are arguably the best business models out there, due to big volumes, good margins, and very scalable.

Everyone wants a piece of the cake, so a lot of projects have been launched in this vertical and each with a slightly different business model (although the amount of exact GMX forks is applaudable).

Even though competition is usually good for users, it makes things harder for projects as they need to remain attractive to users in a fast-paced environment where constant innovation is key.

Current perp dex space is fairly crowded so GMX will need to continue having an edge against other platforms that compete, and likely the best way to do it is focusing on being one of the most liquid venues out there, as that would be the home of the big traders, which are anyways the ones bringing most of the fees in any DeFi project. It is also a more sustainable competitive advantage (vs others like lowering prices).

5.1 Risks of Hacks and Exploits

Hacks and exploits are always the biggest risks for DeFi protocols, especially when new deployments are made. The v2 code is brand new and even though contributors have taken as much care as possible, including several rounds of audits, standard smart contract risks still apply. As such, it would likely be a death blow for the protocol if an exploit took place.

The current TVL of the v1 protocol sits at $544M and paces itself within the top 15 protocols in crypto, so they will surely catch some unwanted eyes.

Source: TokenTerminal

5.2 Ensuring Fee Generation Capacity

Reducing open/close fees by 50% implies that if volumes don’t grow, the fee generation capacity of the protocol will be limited and thus diminish the value of the protocol. Generally, with DeFi protocols, a virtuous cycle (or positive feedback loop) applies, where high volume causes high fee generation, attracting more TVL, and making more liquidity available for volume. However, the opposite is also true, where negative activity leads to a vicious, downward cycle.

That being said, within this new design of more balanced pools and dynamic price impacts, the capital efficiency of the protocol is improved substantially causing less liquidity to be needed to facilitate high orders and high volumes.

5.3 Attracting and Retaining Liquidity

The new model introduces isolated liquidity pools for each pair. Due to this fragmentation, bootstrapping liquidity in v2 will be harder than using a general basket of assets like GLP.

The last year has shown that liquidity is a key driving factor and the most sustainable competitive edge over a mid/long timeframe. On-chain liquidity for perps is still very low compared to CEX liquidity, so big traders only have 2-3 venues with enough liquidity. Those venues will have the higher road as long as demand for perps DEXs is there and the UX is good enough.

5.4 Integration Risks with Third-party Providers

GMX will be reliant on other protocols to some extent. The most important partner is Chainlink with their brand-new low-latency oracles. There will surely be others along the way to improve the liquidity-providing experience, like structured products, improved front-ends, etc.

Most definitely, Chainlink is the only critical partner here, and they are as solid as they come, but low latency oracles are a new product, and as such some small problems could arise in deployment.

5.5 Comparing GMX v2 with the CLOB Model

Broadly speaking there are two different pricing models for perp DEXs, Central Limit Order Book (CLOBs) and Oracle Priced AMMs, each with their advantages and issues.

Both GMX v1 and v2 are Oracle Priced AMMs, whereas dYdX is a CLOB.

Which one is better? Well, it depends on who you ask.

Let’s check the main advantages of each model.

The main advantages of GMX over CLOBs are:

Simpler and easier to use, this being an advantage for basic retail users.

An easier way to provide liquidity in comparison with CLOBs, allowing everyone to earn trading fees and not only professional market makers.

A higher degree of transparency and decentralization – order books are very demanding regarding performance, and as such, most of the protocols with an orderbook, have a hybrid system in which the orderbook is off-chain and the rest of the components are on-chain.

Higher liquidity to trade on average – due to liquidity provision of CLOBs relying almost entirely on active market makers, especially at the initial stages.

Main advantages of CLOBs concerning GMX v2:

Clear separation between takers and makers, providing different fee systems for them and thus being cheaper for certain users (e.g. Market makers)

Trading is not limited by other venues (e.g. oracles) and as such price discovery is feasible in the platform and it is not limited at all by the liquidity of external sources. Arbitrageurs will take advantage of the spreads and balance all the venues, but it is not limited by design as oracle-priced AMMs are.

Faster execution as frontrunning is harder to perform or even impossible on some designs.

6. A Sneak Peek into Trading on GMX v2

6.1 GMX v2 Trading Demystified

In v2 users will be able to choose whether to long, short, or swap between available assets.

Swapping will work similarly to the previous version, users will just need to choose the assets to swap and pay the required fees (0.05% between crypto assets and 0.01% between stables).

It will be a two-step process, to avoid toxic flow while maintaining the best pricing for users.

With respect to leverage trading, traders will be able to select the following variables:

The asset they want to long/short

Pair they want to use (only one pair in some cases)

Select the size of the position (amount of collateral and leverage)

Choose whether to keep the collateral in ETH or stables

Once the asset and size are decided, four different combinations are possible based on the other two variables. It has been plotted in a matrix to make it easier to grasp.

Scenario 1 - Long using ETH as collateral

This option makes sense when someone is very bullish on a long trade and wants to keep the underlying collateral to benefit from the potential appreciation of ETH at the same time. This was not possible with the GLP model and was a very demanded feature by users.

Scenario 2 - Long using stables as collateral

This option makes sense if the user is bullish overall, but thinks the market could go a little bit lower before going up or just wants to stay conservative. Keeping the collateral in stables will achieve a lower liquidation point, which could prove useful under an array of circumstances.

Scenario 3 - Short using stables as collateral

This is the way to maximize the return if the user is expecting lower prices. At the end of the trade, if prices are lower than the entry price the user will net the gains from the trade minus fees plus the whole USD value of the collateral. If price goes up before going down you could be liquidated earlier than keeping the collateral in ETH though, so this is something to keep in mind.

Scenario 4 - Short using ETH as collateral

An interesting option, as it allows in-built delta neutral strategies for ETH, achieving some sort of organic yield-bearing stablecoin.

The way to proceed would be to short 1x ETH while keeping the collateral in ETH, and collecting the funding fees when the APR is positive (longs paying shorts), which happens most of the time. This strategy would be profitable if the funding fees through a time period are higher than the borrowed fees of the position + open/close fees.

It will also allow pair trading and will delve deeper into both examples later.

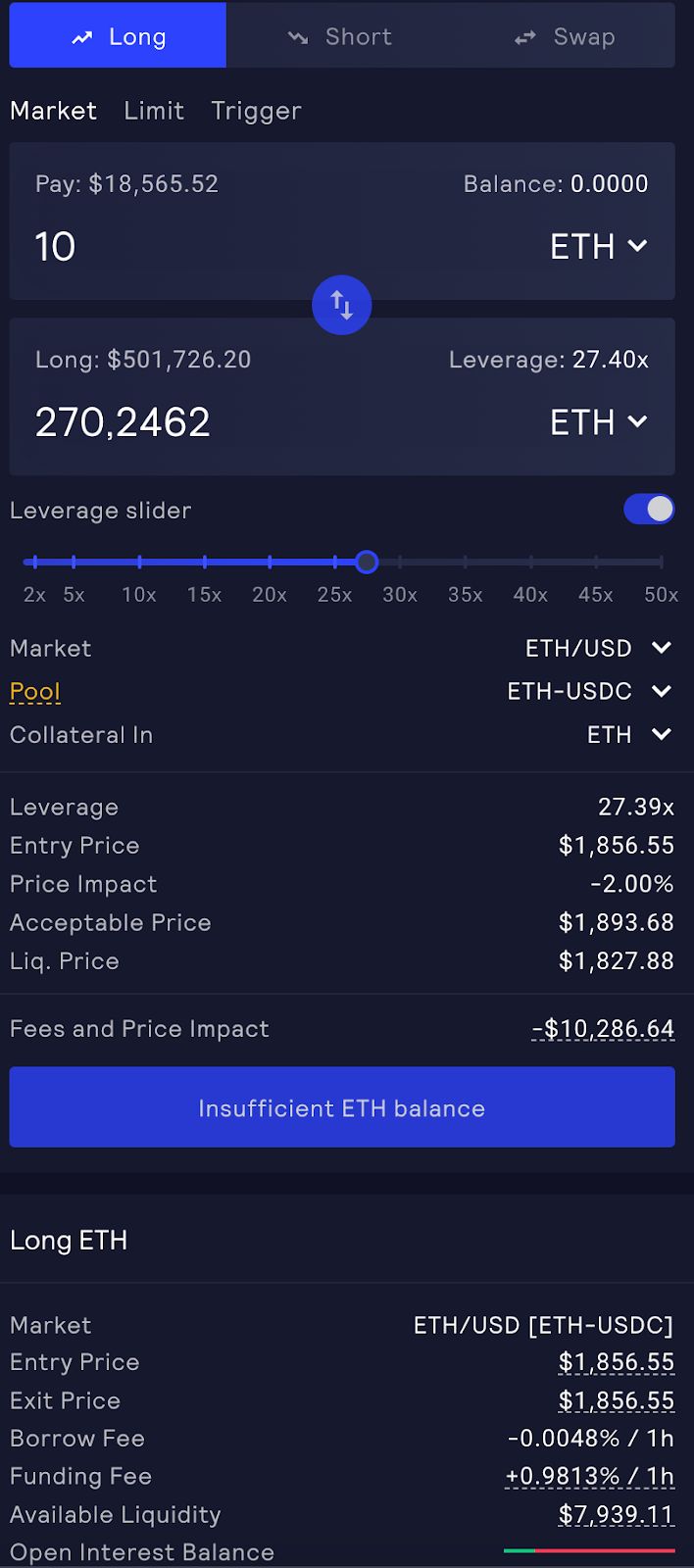

6.2 Understanding Practical Trading Fees in v2

While there are still some unknowns, like what will be the baseline for funding rates APR, the price impact, or even the borrow fee final values. We can get an estimation of how fees would look for a given trade through some simple calculations and estimates.

Let’s say a user opens a long on ETH with 100 ETH collateral value and 10x leverage, bringing the total size to 1000 ETH.

Open/close fees have been reduced to 0.05% of the total size, so the user will be paying 0.5 ETH in open fees and will pay another 0.5 ETH at the close of the trade.

Price impact will affect those trades where the user wants to trade with a bigger size than available on the rest of the market for the selected asset (to prevent manipulation).

In this case, probably will be negligible or zero.

Borrow fees are enforced to encourage trading activity and prevent malicious actors from hoarding all the liquidity at zero cost. Would be expected something around 5% APR cost in normal conditions, so the user would be paying around 0.14 ETH per day the position remains open.

Funding fees will depend a lot on the skew of trader activity, but the baseline probably sits in line with the majority of exchanges around 10.95% APR. Under the assumption of the pool being at balance, this trader being in a long would be paying around 0.28 ETH per day in funding fees.

Each fee section can be viewed in the picture below, numbers are not representative due to the project still being in testnet with unreliable data.

GMX Testnet Order UI

6.3 Delta Neutral Farming Strategies

Not a subscriber yet? Sign Up Today to read this section!

6.4 The Art of Pair Trading with GMX v2

Not a subscriber yet? Sign Up Today to read this section!

Conclusion

As we dissect GMX v2, we uncover meaningful developments that signal a leap forward from its predecessor, consolidating GMX’s position in the dynamic DeFi space. GMX v2 offers a suite of trading functionalities that balance simplicity with transparency and efficiency while opening up fresh avenues for traders and yield farmers to explore.

However, the path to these advancements is not devoid of risks. The potential system exploits, challenges in fee generation, attracting liquidity, integration with third-party providers, and certain trader disadvantages compared to alternative models, stand as formidable hurdles to surmount. These areas require careful navigation to guarantee the protocol's resilience and evolution. With the transition from testnet to mainnet, it's crucial to observe the ripple effects of these changes on the ecosystem and how GMX v2 adeptly maneuvers the complex and rapidly evolving DeFi landscape.

In our journey through Web3, we've had the pleasure of growing alongside the dedicated GMX team over the past 2 years. Their commitment to excellence and an unshakable ethos of integrity never cease to impress us. We have personally witnessed their tireless work ethic, channeled into creating a platform that's truly a game-changer. Their unwavering focus on ensuring security and efficiency while constantly innovating is an inspiration.

Hats off to this formidable team!

Join the conversation